New vehicle prices fell slightly in February after reaching a record high in December, according to new data from Kelley Blue Book. But before you start celebrating, KBB's analysts also report that prices are still nearly $5,000 higher than they were a year ago. Plus, not only did February mark the ninth straight month buyers paid more than sticker price, KBB also says incentives also dropped to a record low last month.

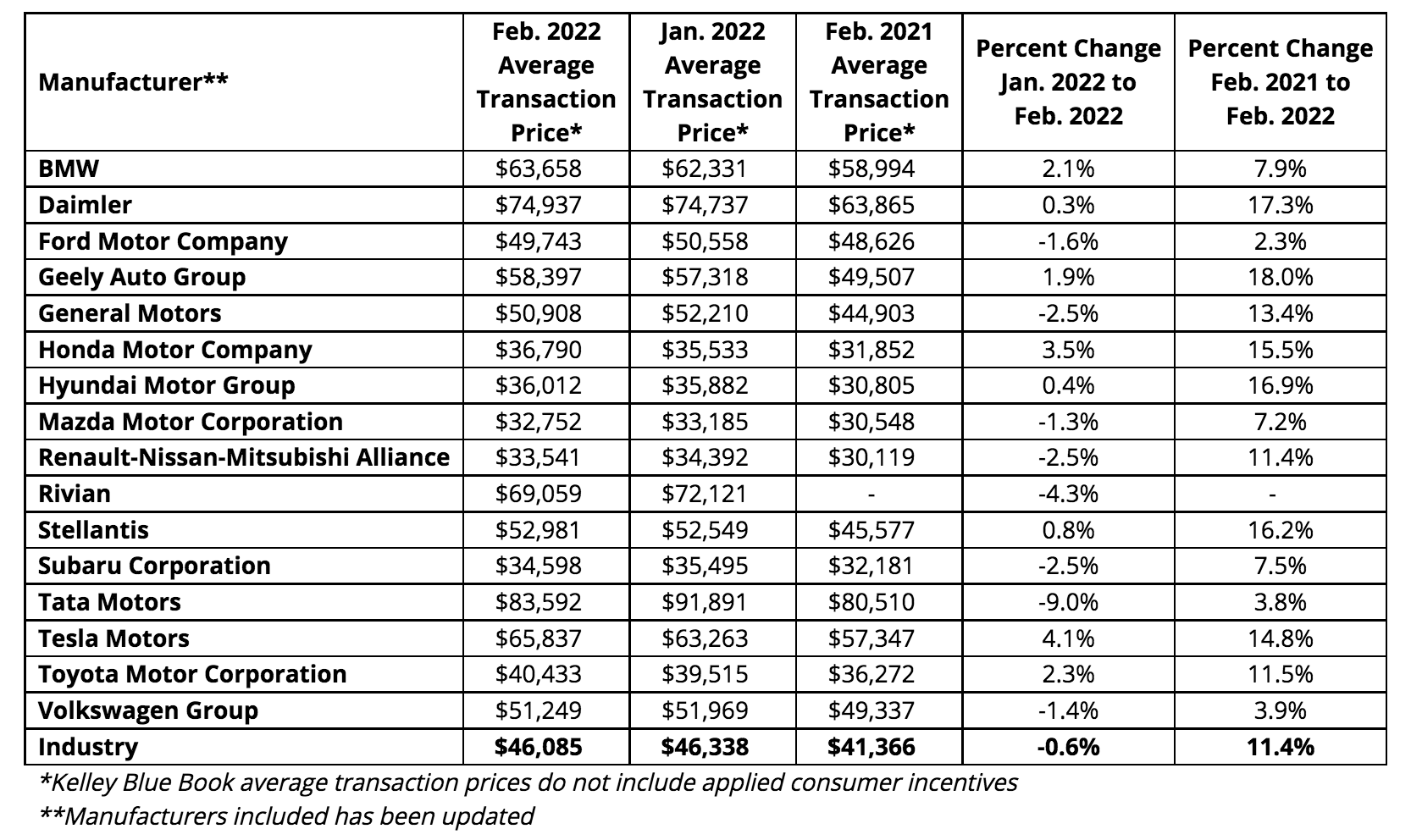

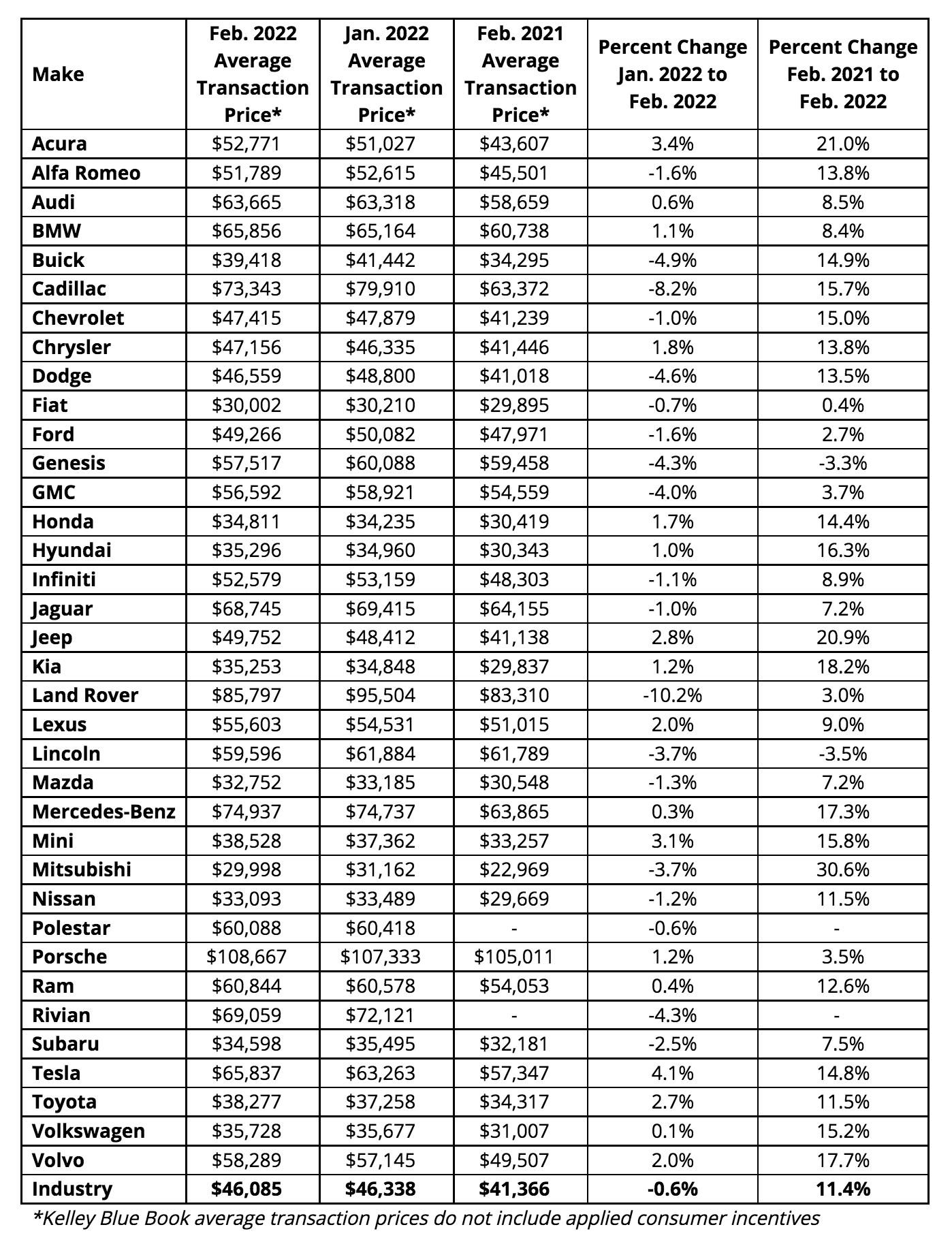

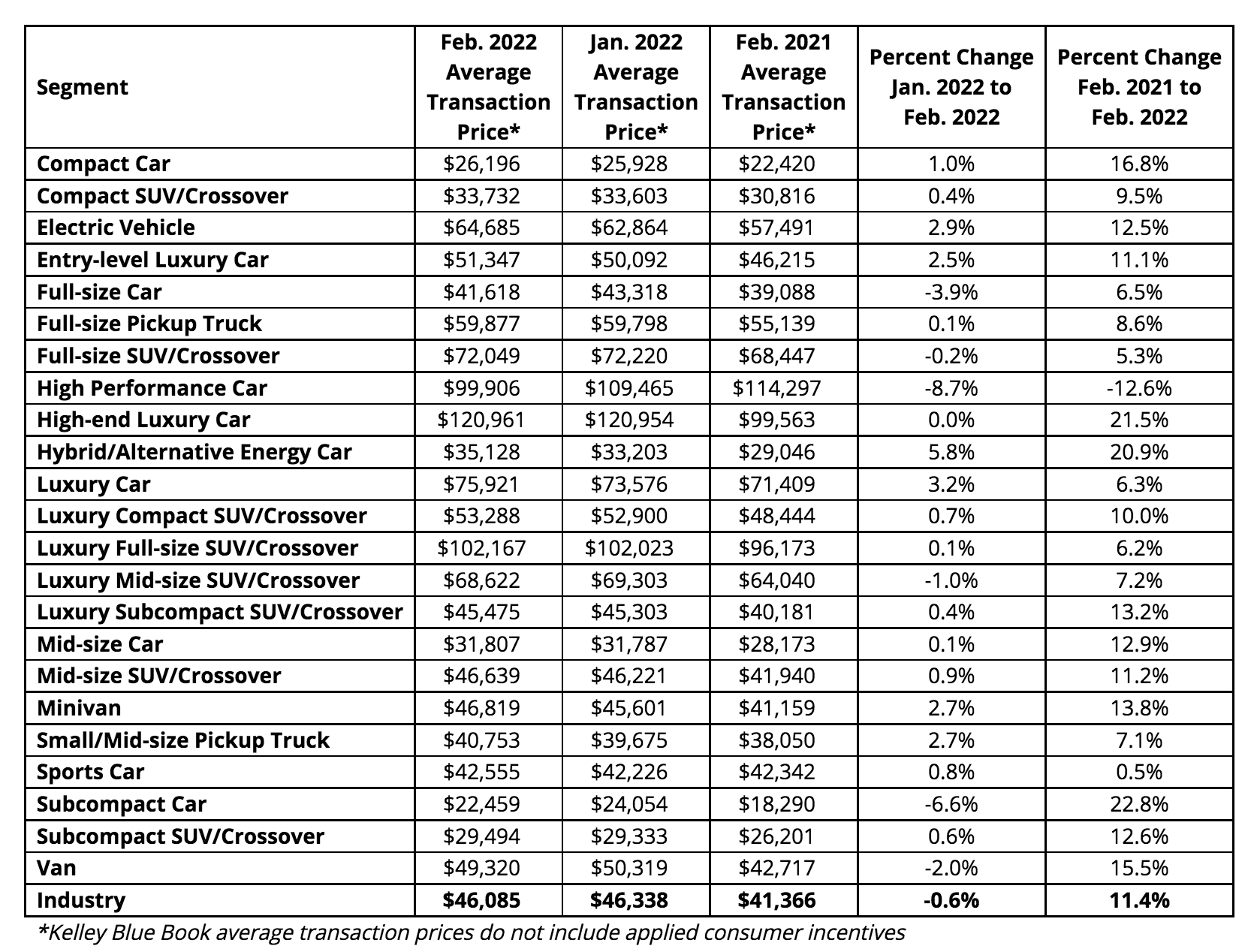

Average Transaction Prices

KBB reports that average transaction prices (ATPs) decreased to $46,085 in February 2022 after December 2021's record high topping $47,000. Analysts attribute the drop to fewer luxury vehicles being sold last month, causing prices to fall 0.5% ($253) month over month. Despite the dip, KBB says prices remain elevated compared to one year ago, up 11.4% ($4,719) from February 2021.

Paying Over MSRP

KBB also reports that new-vehicle inventory edged slightly higher in February, while customer demand remained strong, and according to the Dealertrack Credit Availability Index, auto credit access improved again in February. Analysts say these conditions enabled dealers to continue selling inventory at or above the manufacturer's suggested retail price (MSRP).

"Consumers are paying near top dollar for new vehicles as prices remain high and incentives fall to a record low," said Michelle Krebs, executive analyst for Cox Automotive. "With prices for oil and gas, along with commodities like metals used to build vehicles, soaring due to Russia's invasion of Ukraine, automakers may be compelled to try to offset their increasing costs by raising vehicle prices. The Ukraine situation is causing additional disruption to the automotive supply chain which makes the likelihood of growing inventory, which remains stuck at low levels, less of a sure thing."

Non-Luxury Sales

According to KBB, non-luxury vehicle buyers paid an average new vehicle price of $42,467 last month, down $227 from January, the fourth consecutive monthly decrease. Still, non-luxury buyers still are paying on average more than $900 above sticker price. KBB says consumers have paid more than MSRP for each of the last nine months, whereas one year ago, non-luxury vehicles were selling for more than $1,500 under MSRP.

Luxury Sales

Luxury vehicle sales fell to 16.3% of total sales in February, down from 16.5% of total sales in January and down from 18.4% of total sales in December 2021, which helped to drive overall ATPs to a record high of $47,064 at the end of last year. In February 2022, the average luxury buyer paid $64,626 for a new vehicle, down $183 month over month but still more than $2,500 above sticker price. For comparison, luxury vehicles were selling for more than $2,400 under MSRP one year ago.

Some of KBB's other data:

- New-vehicle average transaction price changes month-over-month were mixed by segment, with cars and trucks increasing and SUVs and vans decreasing.

- With an ATP of $54,920, trucks saw the largest increase of $622, followed by cars ($41,243 ATP) with a $185 increase.

- SUVs ($44,855 ATP) decreased by $605, and vans decreased by $113 to reach an ATP of $48,068.

- Vans still had the lowest incentives (expressed as a percent of ATP) at 1.6%. Incentives dropped to a record low level in February, averaging only 3.6% of the average transaction price.

KBB gives a detailed look at ATPs by overall brand, make and segment in the tables below, used courtesy of Kelley Blue Book:

Photo credit: Virrage Images/Shutterstock.com.