Good news for those of you who put miles on your car for work. Due to higher gas prices, the Internal Revenue Service is increasing the optional national gas mileage rate for 2022 for those eligible to take the deduction. (The IRS says the optional standard mileage rate may be used to calculate the deductible costs of operating an automobile for business and certain other purposes. ) It's a rare move and is effective for the final 6 months of the year. So, as of July 1st, the gas mileage rate will be 62.5 cents a mile, up four cents from the first half of the year. This rate is effective until December 31st.

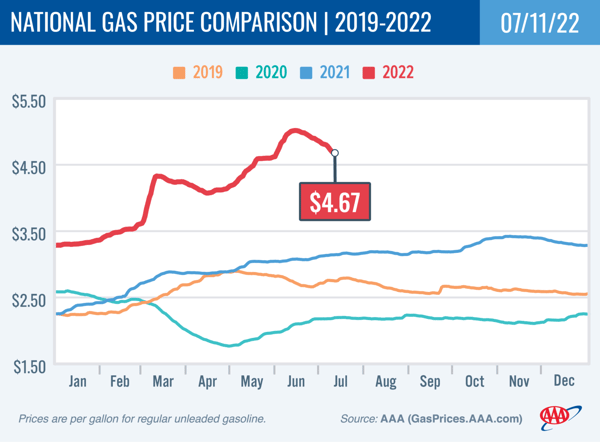

While gas prices have been dropping the past few weeks, they're still up over a dollar and a half over a year ago. AAA reports that the July 11th national average of $4.67 was 32 cents less than a month ago and $1.53 more than a year ago.

The red line in the AAA graph below tells the story:

The IRS says its making the special adjustment for the final months of the year in recognition of higher gas prices. Normally, the IRS updates the mileage rates just once a year in the fall for the next calendar year. Mid-year increases in the optional mileage rates don't happen often. The last time the IRS made such an increase was in 2011.

"The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices," said IRS Commissioner Chuck Rettig. "We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.”

The new rate for deductible medical or moving expenses (available for active-duty members of the military) will be 22 cents for the remainder of 2022, up 4 cents from the rate effective at the start of 2022. Read the IRS legal guidance here. For travel from January 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03. The 14 cents per mile rate for charitable organizations remains unchanged as it is set by statute.

The IRS also notes while fuel costs are a significant factor in the mileage figure, other items enter into the calculation of mileage rates, such as depreciation and insurance and other fixed and variable costs.

The optional business standard mileage rate is used to compute the deductible costs of operating an automobile for business use in lieu of tracking actual costs. It's also used as a benchmark by the federal government and many businesses to reimburse their employees for mileage. The IRS says taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Read the IRS press release here.

|

Mileage Rate Changes |

||

|

Purpose |

Rates 1/1 through 6/30/2022 |

Rates 7/1 through 12/31/2022 |

|

Business |

58.5 |

62.5 |

|

Medical/Moving |

18 |

22 |

|

Charitable |

14 |

14 |

Looking for a Hybrid or Electric vehicle? Check out our reviews of electrified models here or click on the photo below

Photo Credit: nexus 7/Shutterstock.com.